With coming industrial convergence era, there are the necessity of industrial convergence in sport industry. Therefore, the purpose of this study is to provide classification system and trend. This study applied case study method with semi-constructed interview, integrative literature review and observation. In addition, this study provide the conceptual framework for the classification system in sport industry related to industrial convergence. To conclusion, among the several criteria related to industrial convergence for product-new technology criterion, there are virtual sports, diagnosis valuation solution and exercise guide solution for participant sport market. In the case of new technology-service criterion, there are new media and virtual broadcasting for spectator sport market, and u-learning for participant sport market. For product-service criterion, there are complexity of sports facility and sportainment for spectator sport market, and virtual gaming sports and participatory tour for spectator and participant sport market. In addition, the trend of the sport industrial convergence has changed from leading media industry to converging with diverse industry areas.

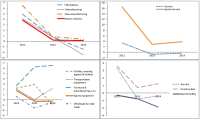

In this paper, we analyzed financial ratio of Sports Industry Enterprises in Korea from 2011 until 2014. We use Kis-Value data and extract 195 enterprise from it. And we compared the results with other industries which data were analyzed from the Bank of Korea. The results of the analysis are that the financial ratios of the sports industry is higher than other industries. This shows that the management conditions in sports industry are better than the other industries. In particular, among the sports industries, the management condition in sports service industry shows better states than other sports industries and other industries. This indicates that the sports service industry is a high value-added industry and growth rate of this industry is much faster than other industries. Growth rate of sales of Sports industry in 2014 was 0.1% whereas growth rate of sales of all industries was –1.5%. Also, growth rate of total assets of Sports industry in 2014 was 3.5% while growth rate of sales of all industries was 3.0%. So, growth ratio of the sports industry was higher than all industries. On the other hand, growth rate of tangible asset which represents the investment in fixed assets was 1.9%, which was lower than that of all industries 2.5%. Through operating income to sales, we can know the profitability of company from operating activities. Operating income to sales of sports industry in 2014 was 9.5% whereas operating income to sales of all industries was 4.3%. Especially sports service industry increased 24.6% in 2014. Income before income taxes to sales was 10.1%, which was higher than all industries 3.9%. In particular sports service industry was 28.3%. It shows that the sports service companies have issued a profit through strong corporate activities. Debt ratio of the sports industry in 2014 was 80.9% while it was 91.9% for all industries. Debt ratio of sports facilities industry was 166.9% that is higher than the average of all industries. But the debt ratio of the sports service industry was 29.9%, it can be seen considerably lower than the average of all industries. Total borrowings and bonds payable ratio of the sports industry was 19.8%, it can be seen lower than the 25.3 percent for all industries. Cash flow coverage ratio which represents the ability to afford the interest and debt to cash income. Sports industry rate was 25.4%. It was lower than the all industry's 62.7% and it indicates sports industry is financially not good. So, we know that sports service industry was financially not healthy. Business analysis results of sports industry of Korea appeared better than other industries. But business conditions are getting worse and, like any other industry. Thus, through the business analysis, we should prepare substantiality of management. And we should plan productivity improvement and business strategies for the changing business environment.

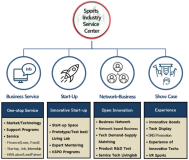

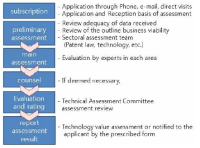

Purpose This study estimated the social value of the Sports Industry Support Center, which will be newly established and operated by the Ministry of Culture, Sports and Tourism, using the contingent valuation method. The survey designed a structured questionnaire for 480 households in 16 cities across the country to explain the necessity and major services of the Sport Industry Support Center and to investigate the willingness to pay for the social value of the center's sports industry support services. According to the NOAA panel's recommendation, the questionnaire survey consisted of dual dichotomous questionnaires and the form of payment in the form of income tax. As a result of analysis through logit model, statistically significant explanatory variables were payment amount, income level and gender. In particular, the higher the income level, the higher the willingness to pay, and the use of income tax as a means of payment was statistically significant. The social value granted to Sports Industry Support Center was 4,576.17 won per household per year, and it was estimated that there was a total of 469 billion won for the five years of income tax payment.

This paper focuses on the analysis of growth policies in the sport industry and the suggestions of the owned demand-pull growth model. The Korean government have enforced the supply-oriented growth policy in the sport industry. However, when the demand for sport is low and inelastic, the supply-oriented growth policy could be less effective. When the supply-oriented growth policy is based on the demand-pull growth policy, the growth policy in the sport industry could be more effective. Concretely, if the government carries out the introduction of sport voucher system, the enlargement of public and private sport facility use, the development of fused policies linked with sport-health-welfare, etc., the sport industry will be advanced more rapidly.

Purpose The purpose of this study was to analyzes the task related to job creation of sport industry sector in the 3rd(2019~2023) sport industry long-term plan and suggest possible revisions of the sport industry relevant laws. Methods This study focused on literature review on sport industry long-term plan, sport related legal and regulations reviews. To achieve the purpose of the study effectively, the legislative purpose and main contents of the Sports Industry Promotion Law were examined, and the legislation and amendment policy measures dealing with new job creation and reinforcement of sport industry manpower, according to sports industry long-term plan. Results First, To promote job creation in sport industry, the provision of sport relevant laws including fostering sport industry specialized manpower, settling down the system to meet the demands of industrial sites and establishing specialized higher education institutions that can strengthen their capabilities. Second, as the paradigm of creating jobs value added in sport industry has changed into a state-of-the-art convergence-and-composite based system such as the Fourth Industrial Revolution, legal systems that can reflect and implement it is urgently needed. Therefore, institutionally preemptive measures should be established before being new technological wave settled down in advance. Third, the development of a curriculum with substantial resources for strengthening the practical competency of sport industry manpower should be continued, and a revision of sport related laws on securing the budget is required. Conclusions By revising the current sport industry associated laws, it is expected to build a cornerstone on promoting job creation in sport industry.

The purpose of this study was to analyze the effects of employee’s job burnout on turnover intention and to draw average effect size(weighted averaged fisher’s z) in sports industry. After a lot of dissertations and journal articles were extracted by searching web sites, 11 papers were finally selected through thorough verification procedure. Specific analyses were conducted via MIX 2.0(Meta-analysis with Interactive eXplanations). The results were as follows. First of all, the weighted average correlation coefficient of between depersonalization and turnover intention was .326. Secondly, the weighted average correlation coefficient of between reduced personal accomplishment and turnover intention was .192. Lastly, the weighted average correlation coefficient of between emotional exhaustion and turnover intention was .326.

PURPOSE This study presents policy implications drawn from a factual survey on the sports services industry in Korea, aiming to understand its current status and provide systematic support for high growth sectors. METHODS The research involved 600 companies across 18 sports service industry sectors, with growth potential assessed using standardized Compound Annual Growth Rate (CAGR) scores based on indicators such as the number of businesses, employees, sales, business productivity, and labor productivity. RESULTS Results revealed that high-growth sectors were more prominent in the Incheon/Gyeonggi regions, while general sectors showed higher proportions in the Seoul area. Satisfaction with government support programs was above average in high-growth sectors, contrasting with lower satisfaction in general sectors, depending on the criteria. Both high-growth and general sectors faced difficulty securing liquid assets, expressing expectations for government financial support, such as expanded loans. CONCLUSIONS Therefore, a policy for achieving regional balance for sports service industries concentrated in the metropolitan area and differentiation in regional sports service industries is necessary. Through a paradigm shift in business support, the competitiveness of the sports services industry can be enhanced, and comprehensive policies for the domestic sports service industry must be formulated.

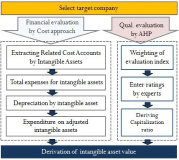

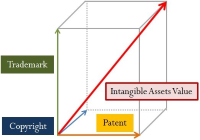

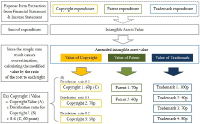

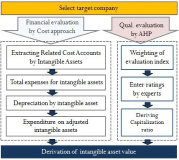

This research intends to present a new model development for properly evaluating intangible assets of sports companies. To accomplish the purpose of this research, cases where observable data such as costs are used to determine value and the application of such evaluation models were explored. Also overseas cases of Patent Litigation Fund, Patent Portfolio Fund, Intellectual Property Incubation Fund and existing loan programs were analyzed. The model development provided by this research utilizes numbers from financial statements in assessing intangible assets, thereby uniting the financial statements with actual value. And more accurate corporate evaluation method would be possible by evaluating intangible assets based on numbers from financial statements was suggested. Therefore, suggested model development first calculates the total goodwill and then divides this among the different types of intangible assets. The criteria of such division is based on the cost involved. This is much more persuasive than estimating future profits or comparing similar companies because it is based on actual cost spent and not vague numbers. This is not completely different from existing profit approach, but rather an evolved form of it. In other words, suggested model development tries to translate goodwill into tangible numbers as much as possible.

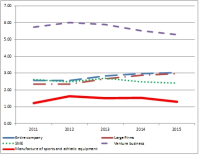

Purpose In recent years, competition among companies has become more and more important to maximize the competitiveness of companies by improving their productivity through technological innovation. Increasing competitiveness through technological innovation is becoming an essential requirement for survival of companies. In order for companies to innovate, it is necessary to spend R&D investment and the government is strengthening various policy supports to do this. Athletic equipment industry classified as manufacturing industry in sports industry. In this study, considering the fact that manufacturing industry occupies a large part of Korea's R&D investment, we compared R&D intensities with athletic equipment industry and other industries. We also examined whether R&D investment has affected firm performance. Methods The data used in the analysis were extracted from KIS-DATA with KSIC codes of companies classified as sports and athletic goods manufacturing industry in the 9th Korean Standard Industrial Classification of National Statistical Office. The analysis period is five years from 2011 to 2015 to look at the current status. Looking at the number of companies extracted by year, it was 42 in 2011, 45 in 2012, 46 in 2013, 48 in 2014, and 39 in 2015. Results Research showed that the intensity of R&D of athletic equipment industry was 1.22% in 2011, 1.63% in 2012, 1.51% in 2013, 1.53% in 2014 and 1.30% in 2015. This was lower than the manufacturing industry, which was a category of athletic equipment industry, and lower than that of similar small and medium sized enterprises. The correlation between R&D intensities and the sales growth rate of firms showed a positive correlation in 2011 and 2015, but the correlation is not strong. Conclusion R&D investment in athletic equipment industry was not actively taking place, and R&D investment did not have a significant effect on the performance of the company.

Purpose In the field of sports industry, the intangible assets of sporting companies often show discrepancies between accounting information and corporate value because of conservative current accounting standards. Therefore, this study intends to present a valuation model of intangible assets of sports industry based on cost approach, as a part of a method of capitalizing intangible property expenditures. And we tried to verify the valuation model of intangible assets derived from the research on actual sports companies. Methods To accomplish the purpose of the study, reviewing the literature on various related precedent studies and examining related valuation methodology, legal basis, and representative valuation models were utilized. And to verify the effectiveness of the derived model, Tobin q values were derived and compared. A simple regression analysis was used to verify the explanatory power of the derived model. Results The financial evaluation was conducted based on the cost approach, which enables relatively objective evaluation through the existing financial statements, and a valuation model with the procedure of duplicating the AHP evaluation to reflect the characteristics of the individual intangible assets was presented. In addition, in order to verify the proposed valuation model, the valuation was conducted by putting the accounting information of the sports companies into the intangible asset valuation model presented in this study. As a result of the statistical analysis on the evaluation results, the intangible asset value evaluation model presented in this study is proved to be significant based on statistically high explanatory power. Conclusion Therefore, if it is possible to appropriately evaluate the enterprise value of sports companies through the intangible asset valuation model based on the cost approach presented in this study, various types of technology financing will be possible in the sports industry. And this is expected to accelerate the growth of the sports industry in the future.